Ferratum Bank je mezinárodní poskytovatel půjček se sídlem na Maltě. Společnost v České republice poskytuje krátkodobé bezúročné půjčky na cokoliv s minimálními požadavky na klienta. Od založení v roce 2005 již společnost expandovala do skoro celého světa. Ferratum Bank je součástí finanční skupiny Ferratum Group, která má pobočky ve 24 zemích.

Ferratum Bank p.l.c. je dceřinou společností Ferratum Group, která získala bankovní licenci od Malta Financial Services Authority. Tato skupina razí heslo „More than money to everyone“ (Více než peníze pro všechny).

Skupina Ferratum Group byla v roce 2005 první společností, která začala v Evropě poskytovat mobilní mikropůjčky. Ferratum půjčka je správná půjčka pro každého, kdo potřebuje rychlou půjčku bez ručení.

Společnost Ferratum Bank nabízí půjčky běžným klientům. Půjčky poskytuje přes internet a telefon, abych zajistila nejvyšší možnou rychlost a přístup k penězům. V současné době nenabízí možnost vedení běžného účtu, spořícího účtu, americké hypotéky ani klasické hypotéky.

V minulosti Ferratum nabízela podnikatelský úvěr Ferratum Business. Tento úvěr pro podnikatele společnost ovšem přestala nabízet od října 2019. Společnost již také nenabízí půjčky Micro Loan ani Plus Loan.

Jako půjčka pro OSVČ či podnikatele je nyní nabízena Ferratum Credit půjčka, kterou mohou využívat také zaměstnanci.

Rychlá půjčka od Ferratum Czech s.r.o.

Ferratum Credit se snaží maximálně přizpůsobit aktuálním potřebám svých klientů. Jedná se o flexibilní úvěr – ovládání půjčky Ferratum Credit má klient ve své režii. Ferratum Credit lze sjednat na tomto odkaze.

Klient si sám nastaví výši splátek i datum splatnosti. Podmínkou je pouze měsíční úhrada alespoň 12,5 % z aktuálně dlužné částky, kterou tvoří čerpaná částka, poplatek za čerpání a denní úroky.

Hledáte rychlou půjčku bez úroku? Vyzkoušejte Zaplo půjčku, která je v případě první žádosti zcela zdarma.

Za poskytnutí ani vedení půjčky Ferratum Credit se nic neplatí. Splatí-li klient alespoň minimální splátku, může si půjčit znovu. V tomto případě si může také navýšit limit půjčky. Výhodou je i to, že tuto půjčku si lze sjednat i bez běžného účtu u Ferratum Bank.

Ferratum Credit je výhodnější než krátkodobé půjčky, protože klient se rozhodne sám, zda vyrovná celý dluh najednou, nebo postupně za několik měsíců. Tento finanční produkt lze získat snadno na základě online žádosti.

Výhodou produktu Ferratum Credit je jistota finanční rezervy na neomezenou dobu. Banka již znovu neprověřuje schopnost splácet, ani není třeba opakovaně žádat o schválení online půjčky. Klienty jistě potěší i to, že lze využít platební prázdniny až 3x ročně.

Potřebujete rychlé peníze ihned na účtu? Porovnejte levné půjčky

Ferratum Credit – parametry půjčky

Ferratum Credit (Credit Limit) je flexibilní úvěr. Funguje na podobném principu jako kontokorent nebo revolvingový úvěr. Po schválení může klient získat 2 500 Kč až 80 000 Kč na účet. Ferratum Credit lze sjednat na tomto odkaze.

Klient si volí, kdy a v kolika splátkách peníze vrátí. Může splatit celou částku jednorázově, nebo využít možnost libovolných měsíčních splátek bez poplatku navíc. Fixní úroková sazba je 12,25 p. a.

Ferratum Credit je splatná až za 30 dnů a více. Poté je každý měsíc nutno uhradit splátku alespoň ve výši 12,5 % z dlužné částky. Ferratum Bank úvěry poskytuje na základě ověření úvěruschopnosti a posouzení bonity.

Ferratum Bank zákaznický účet umožňuje pohodlně čerpat produkty této společnosti. V zákaznickém účtu je možné průběžně sledovat aktuální předschválené nabídky, a také žádat o prodloužení či o platební prázdniny. O půjčku Ferratum Credit lze zažádat skrz tento odkaz.

Ferratum Credit Limit – podmínky

K uzavření smlouvy o půjčce je nutné vlastnit platný český občanský průkaz. Zájemce o půjčku většinou nepotřebuje dodatečné doklady ani se nevyžaduje osobní schůzka. Obvykle se nevyžaduje ani doklad o potvrzení příjmu, stejně jako je tomu například u Kouzelné půjčky.

Další podmínkou je minimální věk 23 let. Věková hranice je nastavena i nahoře – žadatel o půjčku nesmí být starší 85 let. Půjčka je také určena jen těm, kteří u společnosti Ferratum splatili všechny dřívější půjčky.

Ferratum půjčka Credit Limit – kalkulačka splátek

Na přehledných stránkách této společnosti je možné najít i kalkulačku splátek. V ní je možné nastavit si výši půjčky a prohlédnout si další důležité parametry. Mezi tyto parametry patří výše celkové splátky, denní úrok a RPSN. Ferratum Credit lze sjednat na tomto odkaze.

Ferratum půjčka si dává záležet na tom, aby klienti věděli, že se opravdu jedná o půjčku bez poplatků. Ferratum půjčka Credit Limit nezahrnuje ani žádné skryté poplatky. To vše je vidět i v kalkulačce splátek, kde se vedle každého typu poplatku zobrazuje 0 Kč. O jaké poplatky se jedná?

- Poplatek za sjednání a vedení úvěrového účtu

- Poplatek za čerpání

- Poplatek za předčasné splacení

- Poplatek za změnu data splatnosti

- Poplatek za sjednání platebních prázdnin

Reprezentativní příklad při půjčce ve výši 10 000 Kč.

| Trvání úvěru | na dobu neurčitou |

| Úroková sazba | 12,25 % p.m. |

| Výše měsíční splátky | 6,5 % z nesplaceného úvěru nebo 1 000 Kč, podle toho, která z těchto částek je vyšší |

| Celková splatná částka | 14 117,72 Kč |

Ferratum půjčka Credit Limit – žádost o půjčku

Získání tohoto úvěru je poměrně snadné. V online kalkulačce si zájemce nejprve zvolí požadovanou částku a poté vyplní online žádost. Úvěry jsou poskytovány na základě ověření úvěruschopnosti a posouzení bonity.

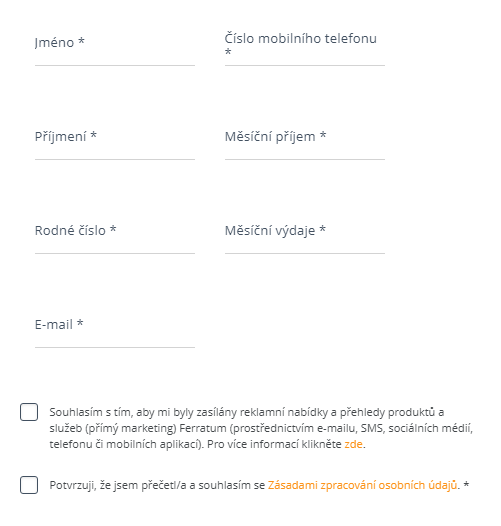

Pokud dojde ke schválení žádosti, zájemce dostane peníze na účet. Online žádost k vyplnění je velmi jednoduchá. Žadatel o půjčku nejprve vyplní jméno, příjmení a rodné číslo.

Poté zájemce musí vyplnit kontaktní údaje v podobě e-mailu a telefonního čísla. Dále je nutné vyplnit svůj měsíční příjem a také měsíční výdaje. Na základě tohoto formuláře se zájemce dozví, jakou částku může získat.

Po odeslání formuláře ze zákaznického servisu přijde zpráva o schválení či zamítnutí půjčky na telefon žadatele. V případě schválení půjčky přijde autorizační SMS s kódem, kterým žadatel potvrdí svůj souhlas se smluvní dokumentací.

Následně jsou peníze odeslány na bankovní účet uvedený žadatelem. Tyto údaje také přijdou v podobě textové zprávy na mobilní telefon nebo žadatele kontaktuje zákaznický servis s bližšími informacemi.

Žadatel peníze obdrží obvykle do následujícího pracovního dne od schválení žádosti. Před požádáním o další půjčku je nutné nejprve splatit tu předchozí. U Ferratum Bank je tedy možné mít aktivní jen jeden finanční produkt.

Po vyplacení peněz Ferratum zašle na e-mailovou adresu výpis účtu, na kterém jsou k nalezení všechny potřebné platební symboly k uhrazení půjčky. Při placení Výpisu účtu je nutné uvést variabilní symbol žadatele, aby banka mohla platbu přiřadit ke správnému úvěru.

Půjčku je možné splatit i před dnem splatnosti. Klient může kdykoliv uhradit vyšší splátku, než je předepsaná minimální splátka. Také je možné celou půjčku splatit kdykoli před termínem splatnosti. Ušetří se tak na denních úrocích a sníží se tím i nákladovost půjčky. Ferratum Credit lze sjednat pomocí tohoto odkazu.

Máte zájem o půjčku od nebankovní společnosti? Nabízí se půjčka ihned bez příjmu

Ferratum recenze

Ferratum Bank recenze jsou různorodé, jak už to bývá u většiny bankovních i nebankovních společností. Webový portál pujckyhned.cz hodnotí tento finanční produkt celkem vysoko. Celkové hodnocení je zde 73 %.

Vysoce hodnocená je zde spolehlivost – Ferratum Bank je zákazníky považována za víceméně důvěryhodnou společnost. V mnoha případech jsou půjčky navíc schvalovány během několika minut a s minimální byrokracií. Proto je vysoce hodnocená i rychlost vyřízení.

Další stránky, jako je např. kvalitnipujcka.cz a okfin.cz, se na svém hodnocení shodují. Jejich celkové hodnocení je 50 %. Nevýhodou Ferratum Credit půjčky je vysoké úročení a poplatky za pozdní splátky.

Výhodou naopak je, že peníze je možné kdykoliv předčasně vrátit. Potenciální žadatele také jistě potěší přehledné stránky s úvěrovou kalkulačkou.

O společnosti

Ferratum Bank je původně nebankovní společnost Ferratum, která se transformovala v bankovního poskytovatel půjček a cílí na běžné klienty. Založena byla v roce 2005 a bankovní licenci získala na Maltě.

V případě potřeby je možné kontaktovat zákaznický servis, který je k dispozici od pondělí do pátku od 8 do 18 hodin. Klienti jej mohou využít pro pomoc se žádostí o úvěr, při potřebě dozvědět se termín a výši splátky, nebo v případě, že nemohou uhradit splátku včas.

Kontakt

www.ferratum.cz

info@ferratumbank.cz

245 001 715

Sídlo společnosti:

Ferratum Bank p.l.c.

ST Business Centre

120 The Strand

Gzira, GZR 1027, MALTA

Zákaznická infolinka:

245 001 715

255 719 133